Key Takeaways:

- Businesses in Dubai frequently need to amend their licenses to reflect changes in ownership, activities, or structure.

- Common amendments include changing trade names, adding or removing business activities, modifying share capital, or updating management details.

- The amendment process varies between mainland companies (Department of Economy and Tourism – DET) and free zone authorities.

- Proper documentation, board resolutions, and timely submission are critical for a smooth amendment.

- Consulting with a business setup specialist can simplify the process of amending your Business setup in Dubai.

A dynamic business environment like Dubai means that companies rarely remain static. As businesses grow, pivot, or adapt to market demands, changes to their initial Business setup in Dubai become necessary. These changes, whether minor administrative updates or significant structural shifts, require formal amendments to the trade license and associated company documents. Failing to amend your business license to reflect current operations or ownership can lead to non-compliance, fines, and even legal repercussions. Understanding the various types of amendments and the procedures involved is therefore a crucial aspect of maintaining a legally compliant and adaptable Business setup in Dubai.

Why Amending Your Business setup in Dubai is Essential?

Amending your Business setup in Dubai license is not just a regulatory obligation; it’s a strategic necessity that ensures your business remains compliant, operational, and poised for growth.

- Ensuring Legal Compliance and Avoiding Penalties:

- Operating a business with outdated or inaccurate license information can lead to significant fines and penalties from the Department of Economy and Tourism (DET) for mainland companies or the respective free zone authorities.

- An expired or incorrect license can also cause issues with other government entities, banks, and even clients, who often verify license details for due diligence. Maintaining accurate records is fundamental to legal operation in the UAE.

- Adapting to Business Growth and Diversification:

- As your business matures, you might want to expand your service offerings, add new product lines, or enter new market segments. These changes often require adding new business activities to your trade license.

- For example, a marketing consultancy might decide to venture into digital product development, necessitating the amendment of its license to include software development activities. Proactive amendment allows your Business setup in Dubai to seize new opportunities legally.

- Reflecting Changes in Ownership and Management:

- Businesses frequently undergo changes in their shareholding structure, whether it’s adding new partners, removing existing ones, or changing ownership percentages. Similarly, management teams evolve, with new directors or managers being appointed.

- These changes must be formally updated on the trade license and in the company’s Memorandum of Association (MOA) or Articles of Association (AOA) to reflect current legal ownership and management responsibilities. This ensures transparency and avoids future disputes.

- Maintaining Banking Relationships and Operational Integrity:

- Banks in the UAE regularly cross-reference company information with the licensing authorities. Any discrepancies between your bank records and your officially registered license details (e.g., outdated trade name, incorrect shareholder information) can lead to bank account freezing, transaction blocks, or difficulties in opening new accounts.

- Keeping your license details current ensures smooth financial operations and maintains the integrity of your business dealings.

- Boosting Credibility and Investor Confidence:

- A business that consistently maintains updated and accurate licensing information projects an image of professionalism and reliability. This is particularly important when seeking new clients, forming partnerships, or attracting investors.

- For potential investors or acquirers, a clean, up-to-date legal structure and compliant documentation are indicators of a well-managed and low-risk business, significantly increasing its attractiveness and valuation.

By understanding these critical reasons, businesses can view amendments not as a bureaucratic burden, but as an integral part of responsible and forward-looking Business setup in Dubai.

Common Amendments for Business setup in Dubai

Businesses in Dubai often need to modify various aspects of their existing setup. Understanding the most common types of amendments helps in preparing for the process.

- Change of Trade Name:

- Reason: Rebranding, mergers, aligning with an international parent company, or simply a desire for a more suitable or memorable name.

- Process: Requires checking the availability of the new name with the Department of Economy and Tourism (DET) or the Free Zone Authority, reserving it, and then applying for the name change on the license. This often involves amending the Memorandum of Association (MOA) or Articles of Association (AOA).

- Addition or Removal of Business Activities:

- Reason: Expanding into new markets, diversifying service offerings, streamlining operations by removing obsolete activities, or adapting to industry trends.

- Process: Involves submitting an application to add or remove specific activity codes from your license. Certain activities may require additional approvals from other government entities (e.g., healthcare activities from DHA, education from KHDA). This also often necessitates an MOA/AOA amendment to reflect the new scope.

- Changes in Share Capital:

- Reason: Increasing capital (e.g., to fund expansion, meet regulatory requirements for certain activities, or accommodate new investments) or decreasing capital (e.g., due to restructuring or returning capital to shareholders).

- Process: This typically requires amending the MOA/AOA to reflect the new capital amount. For capital reductions, additional financial documentation or auditor’s reports might be necessary to prove solvency.

- Changes in Shareholding Structure (Adding/Removing Partners/Shareholders):

- Reason: Bringing in new investors, a partner exiting the business, transfer of shares, or a change in ownership percentages.

- Process: This is a significant amendment. It involves a formal share transfer agreement, a board resolution approving the change, and an amendment to the MOA/AOA. All new shareholders or partners will need to submit their passport and Emirates ID copies. Existing partners being removed may need to provide an NOC. For mainland companies, this usually requires notarization.

- Changing or Adding Managers/Directors:

- Reason: New leadership appointments, resignation of existing managers, or changes in authorized signatories.

- Process: Requires a board resolution approving the change, submission of the new manager’s/director’s passport and Emirates ID copies, and updating the company’s official records with the licensing authority. This typically does not require an MOA/AOA amendment unless the manager is also a shareholder whose shares are affected.

- Change of Business Location/Address:

- Reason: Relocating to a new office, upgrading premises, or changing from a virtual/flexi-desk to a physical office, or vice-versa.

- Process: Requires a new valid tenancy contract for the new premises. For mainland companies, this means a new Ejari registration. For free zones, a new lease agreement. The license address will then be updated based on this new contract.

These common amendments highlight the dynamic nature of a Business setup in Dubai and the need for businesses to remain agile and compliant with regulatory changes.

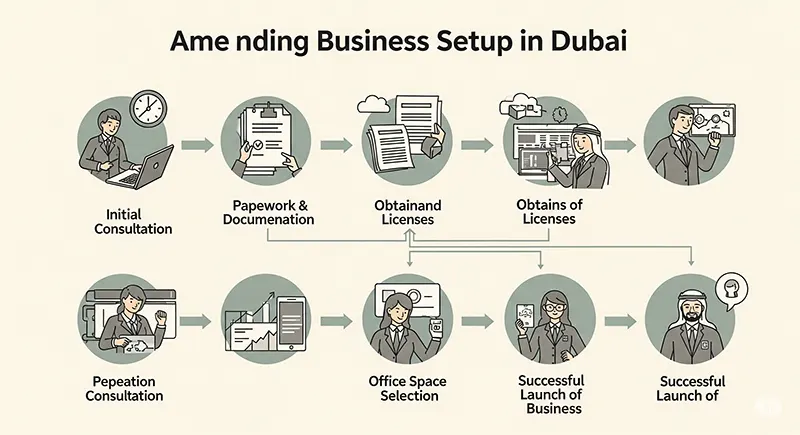

Amending Business setup in Dubai: Mainland Process

Amending a mainland Business setup in Dubai license is primarily handled by the Department of Economy and Tourism (DET). The process is fairly standardized but requires careful attention to detail and documentation.

- Identify the Required Amendment(s):

- Clearly define what changes need to be made (e.g., change of trade name, adding a new business activity, altering shareholding). This first step dictates the specific forms and documents required.

- Obtain Initial Approval (if applicable):

- For certain complex amendments, like a significant change in business activity or legal form, you might first need to obtain an initial approval from DET before proceeding with the full amendment application. This ensures the proposed change is permissible.

- Prepare Required Documents:

- BR1 Form: This is the standard application form for license amendments and must be completed accurately.

- Original Trade License: A copy of your current, valid trade license.

- Passport & Emirates ID Copies: Of all existing and new partners/shareholders/managers.

- Memorandum of Association (MOA) Amendment: For changes in trade name, business activities, share capital, or ownership, a new MOA reflecting these changes must be drafted and attested by a Notary Public. This is a crucial step for mainland LLCs.

- Board Resolution: A formal board resolution (or shareholder resolution) approving the specific amendment, signed by all authorized signatories.

- Tenancy Contract (Ejari): For address changes, a new Ejari-registered tenancy contract for the new premises.

- No Objection Certificates (NOCs):

- From Existing Partners/Managers: If a partner or manager is being removed.

- From External Authorities: If adding a regulated business activity (e.g., Dubai Health Authority for medical, KHDA for education).

- Share Sale Agreement: If shares are being transferred between existing or new partners.

- Submit Application and Pay Fees:

- Online: Most amendments can be initiated and processed through the Invest in Dubai portal or the DET e-Services portal, offering convenience and faster processing times for simpler changes.

- Service Centers: You can also visit any of the authorized service centers (e.g., Tas’heel, Amer centers) for in-person submission.

- Fees: Amendment fees vary significantly based on the type and number of changes. You will receive a payment voucher after the application is reviewed. Payment can be made online or at the service centers.

- Await Approvals and Receive Amended License:

- DET will review the application and supporting documents. For straightforward amendments, approval can be quick (often within hours or a few days). More complex changes, especially those requiring external approvals, will take longer.

- Once approved and fees paid, you will receive your new, amended trade license, often in digital format immediately.

- Update Other Registrations (if applicable):

- VAT Registration: If a change in business activity impacts your VAT obligations, inform the Federal Tax Authority (FTA).

- Bank Account: Notify your bank of any changes to your trade name, shareholding, or authorized signatories.

- Immigration: For changes affecting visa sponsorships (e.g., change of owner, manager), ensure the General Directorate of Residency and Foreigners Affairs (GDRFA) and MOHRE records are updated.

Engaging a reputable business setup consultant can significantly streamline the process for amending your Business setup in Dubai on the mainland, ensuring all legal requirements are met.

Amending Business setup in Dubai: Free Zone Process

Amending a free zone Business setup in Dubai license follows a similar logic to mainland amendments, but the process is managed entirely by the specific free zone authority where your company is registered. Each free zone (e.g., JAFZA, DMCC, DAFZA, or SPC Free Zone in Dubai) will have its own slightly varied procedures and forms.

- Consult Your Free Zone Authority’s Guidelines:

- Before starting, check the official website or contact your specific free zone authority for their precise requirements for the type of amendment you need. Their portals often have dedicated sections for amendments.

- Prepare Required Documents:

- Application Form: The free zone’s specific amendment application form.

- Current Trade License: A copy of your existing valid free zone license.

- Passport & Emirates ID Copies: Of all existing and new shareholders, directors, or managers.

- Board Resolution: A formal board resolution (or shareholder resolution) approving the specific amendment, signed by authorized representatives.

- Memorandum of Association (MOA) / Articles of Association (AOA) Amendment: For changes in trade name, business activities, share capital, or ownership, a new MOA/AOA reflecting these changes will be required. These usually do not require notary attestation but must be approved by the free zone authority.

- Share Transfer Agreement: If shares are being transferred.

- Lease Agreement: For office address changes, a new lease agreement for the updated premises.

- Audited Financial Statements: Some free zones (especially for share capital changes or complex ownership transfers) may require recent audited financials.

- No Objection Certificates (NOCs): From existing partners/managers if they are being removed. External authority NOCs may be needed for certain regulated activities.

- Submit Application and Pay Fees:

- Online Portal: Most free zones, including SPC Free Zone in Dubai, strongly encourage and facilitate online submission through their dedicated company portals. This is often the quickest method.

- Customer Service: You can also visit the free zone’s customer service desk for in-person submission.

- Fees: Amendment fees vary by free zone and the complexity of the change. The free zone authority will issue an invoice for payment once the application is reviewed.

- Await Approvals and Receive Amended License:

- The free zone authority will review your application and documents. Processing times depend on the free zone and the nature of the amendment. Simple changes might be processed in a few days, while complex ones can take longer.

- Once approved and fees are paid, the free zone will issue your new, amended trade license, usually as a digital copy available for download from their portal.

- Update Related Records:

- Bank Account: Inform your corporate bank of any changes to trade name, shareholding, or authorized signatories.

- Establishment Card & Visas: Any changes affecting company ownership or management will likely necessitate an update to the company’s Establishment Card and potentially affect visa sponsorships. You will need to coordinate with the free zone’s immigration department for visa amendments (cancellation, new applications, status change).

- FTA Registration: If the amendment impacts your company’s VAT or Corporate Tax registration details, inform the Federal Tax Authority (FTA).

SPC Free Zone in Dubai, known for its efficient processes, aims to make amendments as straightforward as possible through its online platform, accommodating a range of changes from activity additions to share transfers. Regardless of the free zone, engaging a knowledgeable business setup consultant can significantly ease the burden and ensure compliance throughout the amendment process for your Business setup in Dubai.